Market Summary

The economy continues to be in flux as states and regions of our country struggle to find safe means of reintroducing the aspects of life and routine(s) that many of us are accustomed to. One such aspect being the normality of brick-and-mortar style businesses, namely restaurants and retail. The nature of these two establishments make them heavily dependent on foot traffic, which quarantine and social distancing capacity constraints have made uniquely challenging.

Restaurants have been able to accommodate business with the use of digital apps such as Postmates and UberEats. However, this change eliminates the need for a full waitstaff, which accounts for roughly $40.45 billion in disposable income and plays a very key role in stimulating businesses in the ecosystem of product.

Similarly, retail stores, are not only at a disadvantage because of the lack of in-store foot traffic and disposable income (as previously stated), but also their alternative sales strategies are, in most cases, limited to their digital presence. While that should incentivize brands to consider a digital face-lift or place more bets on driving web traffic, most brands remain hesitant to dive into this unchartered territory.

Despite all of the competition that retail faces in the digital domain, it is not all “doom and gloom” from the retailer’s perspective. As a broker of many different products composed of various brands across many different categories, retailers have the great opportunity to be the one-stop-shop that the individual supplier cannot be due to their limited product offerings.

This month, we drill-down into the world of Digital and common success factors to consider regardless of where you are in the ecosystem of product.

I. Operating During Times of Uncertainty

In response to the challenges at play with COVID-19, business owners and employees alike are asking questions pertaining to how long we can expect this state of abnormality to last. According to a study conducted earlier this year by Ernst & Young (EY), companies are operating under 1 of 3 assumptions. 38% of companies are expecting a return to normal economic activity in the 3rd Quarter of 2020 –this assumption would be recognized as a V-shaped recovery. 54% of companies are expecting a longer period of slow economic activity that could push into 2021 – which is considered a U-shaped recovery. And 8% of businesses are preparing for the recession to be sustained until 2022 at the earliest – which is known as an L-shaped recovery.

As we are now a few weeks into Q3, a V-shaped recovery is a very optimistic outlook. The likelihood of a true V-shaped rebound at the macro-level is diminishing, but there are flickers of light at the end of the tunnel. On the ground-level, we see “micro-recoveries” happening in less populated municipalities. Due to factors such as less population density, the outbreak has been mild which has in many cases afforded them the ability to move through the reopening process with fewer relapses. The downside is that the smaller cities account for an equally small piece of the economic pie. In 2018, the 50 largest metropolitan areas (by Real GDP) contributed more than$13.1 trillion to the country’s GDP, which is more than 60% of the U.S. total. As such, these are the cities that need to be up and running for an economic rally begin, but they are also the same cities that have had more trouble with reopening phases.

What is particularly unusual about this pandemic is how much progress has been made in different parts of the world, yet how much we still do not understand about the virus itself. Bearing that in mind, there is no clear answer on how long this will last. Past crises were unable to prepare organizations for an international health emergency of this caliber, but we strongly believe that preparing for the worst-case scenario (regardless of how retroactive the preparation is) will not only help insulate businesses under the current circumstances, but better position it to capitalize on future opportunities and minimize the impact of ongoing threats.

Another study conducted amidst these unexpected events, indicated that 78% of business leaders were either actively taking steps to change or recognized the need to re-evaluate operational decisions in one or more of the following areas: digital transformation, global supply chain, speed of automation and workforce management.

II. Is Digital Transformation Really the Answer?

Before 2020, digital transformation (DT) was used by CIOs as a buzzword or euphemism meaning modernization – the abuse of the term was extended to both to external partners and internal teams evenly. Where in prior years the notion of a DT was farfetched, COVID-19 has today’s executives forced to embrace a full-on DT instead of exploring the waters cautiously.

Since there is no such thing as an off the shelf product that can be unboxed and implemented, DT requires a serious investment in time and the creation of a strategy for the way an organization rethinks technology, people and processes along its customer value journey. Effectus recommends the following four Digital Success pillars for those embarking on a potential transformation engagement:

Pillar 1 – Consumer Centric Strategy: When defining the strategy behind a DT, it is not enough to do exactly what a competitor is doing. Instead, the technology in question should be carefully selected and in line with the organization’s broader strategy. Be mindful of the technology you choose to implement as it should be a means of accelerating existing processes rather than creating new ones. Lastly, in today’s consumer centric world, strategy should be rooted in an understood and analyzed consumer journey.

Pillar 2 – Experience Design (from the outside-in): This means designing the technology with the end-user in mind and marrying the end-user’s needs with your organizations. As such, it is critical to understand who your user is. For public expressions of your business, such as a digital storefront, you are designing for the consumer. For technology to be used internally, the end-user is a member of your team. Be hesitant about implementing cookie-cutter templatized solutions brought by third-party consultants. These are often a great starting point from an architecture perspective, but the best DT is rarely a one-size-fits-all solution.

Pillar 3 – Embrace a culture of change: This pillar is best exhibited by start-up companies. Rarely is anything perfect on the first try, and this is the case with a DT as well.

The adoption process can be very frustrating and even uncomfortable, especially for those who have been doing things the same way for decades on end. By promoting a willingness to communicate, collaborate and cooperate, the iterative process that takes place will yield effective results that will last.

III. Utilizing Digital Talent

For industry veterans who have successfully run businesses prior to the Digital Revolution, the thought of a digital transformation is believed to have low return on investment (ROI) and be more trouble than it is worth. For the opportunistic leadership team with an appetite for change, they recognize that this is an area for improvement and will begin planning a path forward with a talent search.

As with any hiring process, it is not enough to simply know something is missing from your team’s current skillset. Instead, leadership should have a clear understanding of what those skills are and how they are conducive to the business’ strategic path. When hiring decisions are made without these two fundamental understandings, stakeholders tend to struggle with the utilization of their newly acquired talent. For teams who are less familiar with the ins-and-outs of a digital transformation, the management of digital talent can be extremely challenging. Sustainable digital transformation requires a ‘know-how’ in the following areas: design, architecture, change management, implementation, adoption and the ongoing maintenance required to achieve digital effectiveness that translates into the highest possible ROI for your business.

For businesses that currently lack the aforementioned expertise and know-how, staffing digital talent should be done with a top-down approach in mind. This means starting with someone at the management level who has a strong understanding of the goal-state and the ability to design, communicate and manage the process that yields said goal-state. Without dedicated leadership for the digital segment of a business, this often results in current leadership being forced to juggle a new set of responsibilities with already limited bandwidth. The downstream impact of this lack of specialized leadership is increased difficultly in an organization’s ability to implement, scale and sustain the enterprise success of a digital transformation. With technical leadership in place, businesses set themselves up for success when building out the lower, more specialized tiers of their digital talent spectrum enabling them to effectively intertwine the technology, data, process and change management aspects of their digital strategy.

IV. Setbacks Across the Restaurant and Retail Industries

Over the last few months, businesses have felt the pressures of COVID-19 which has resulted in being especially strapped for cash and forced to furlough/lay-off personnel. Due to a lack of job security across the board and the prolonged risk of pandemic exposure, more consumers continue to shift their priorities towards a more conservative use of funds that would insulate them from an unexpected ailment, especially under circumstances when individuals lacked health insurance.

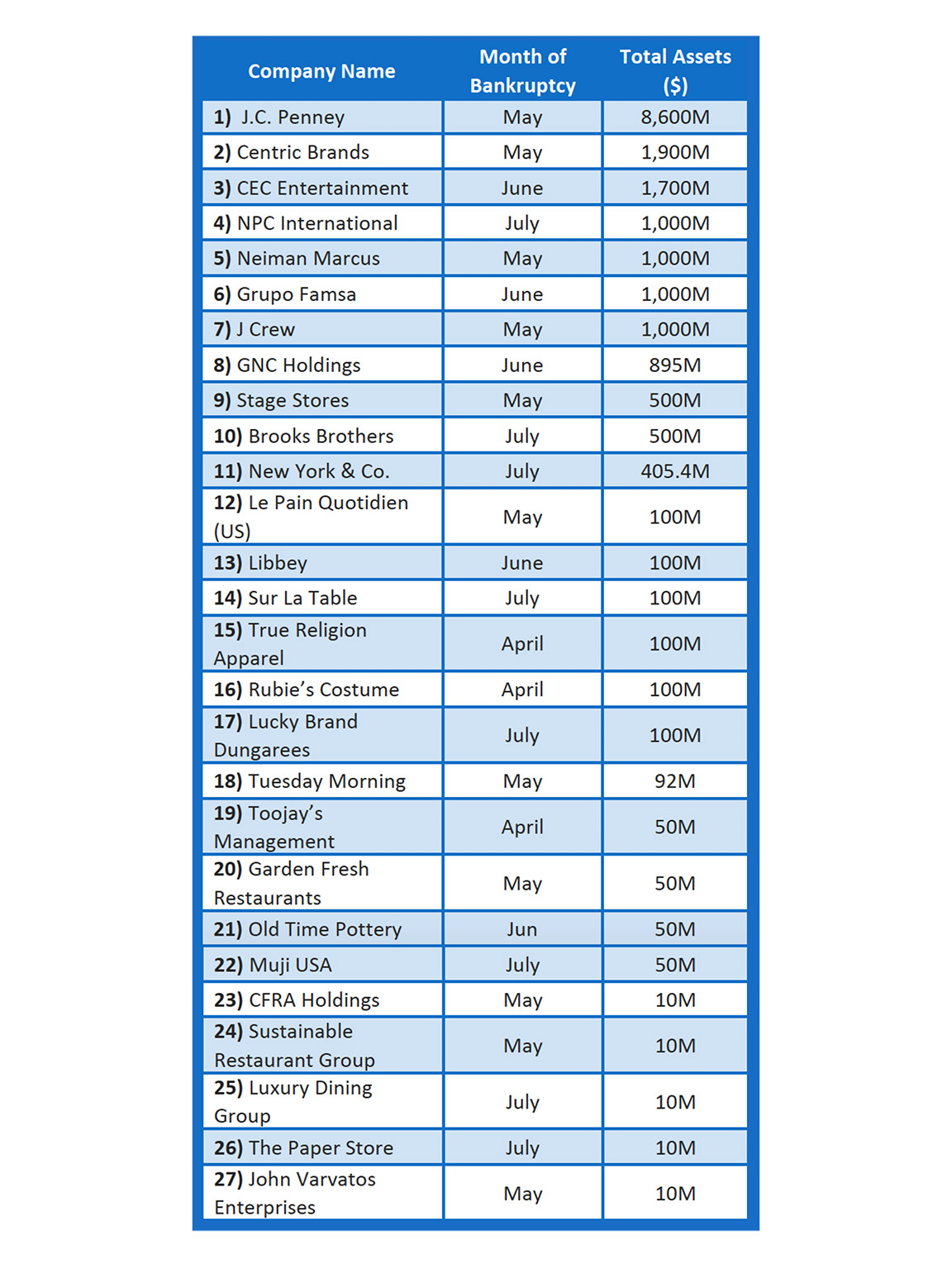

The aforementioned shift in consumer sentiment has been a catalyst for companies dealing with financial strain. This has proven especially true for front-line service providers such as: restaurants and retail. Below is a list of distressed companies in these categories who have initiated some form of bankruptcy or restructuring process over the last few months: