Background

The month of May not only brought spring showers but also a surge of hope, as we started to see parts of our country begin to adopt a new normal. According to the Bureau of Labor, unemployment in April (considered to be the peak of the pandemic) was a record 14.70%, but as the country began its various reopening phases, the number decreased for the first time to 13.30% – while still too early to tell, some speculate a step towards recovery. In the midst of this revival, the outlook is optimistic, but experts say long-term changes are in the horizon. The sooner that executives in the Ecosystem of Product can identify and prepare for those changes, the easier the path forward will be.

Market Watch Summary

Although the pandemic has been difficult for the majority, if not all, of Americans, we have been able to glean a few insights and learnings to take with us into the future.

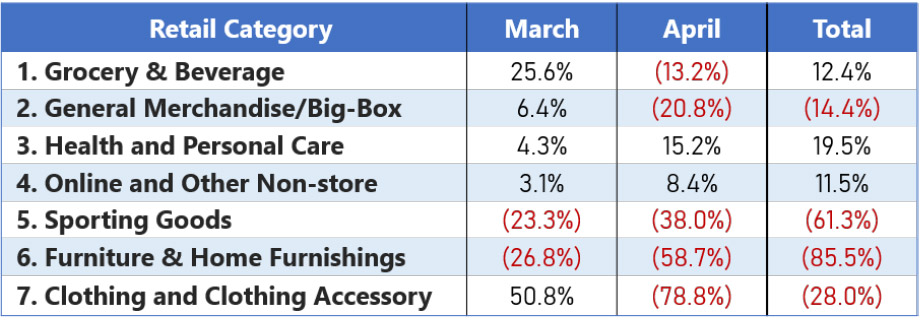

Over the last several years, the talk of a ‘retail apocalypse’ has been a trending topic. Earlier this year, CNBC reported that over 50% of department stores in malls were predicted to close by 2021, and more broadly, over 100,000 stores would be set to close by 2025. While these predictions are unnerving, however, Covid-19 has actually shined light on the need for an on-site brick-and-mortar establishment to a certain capacity. According to the National Retail Federation (NRF) and National Public Radio (NPR), we have been able to analyze a few trends from February through April that strongly indicate the consumer need for a ‘touch and feel’ experience across several industries. Month-over-month, online and other non-store sales were up 3.1% (seasonally adjusted) in March and an additional 8.4% gain in April. The correlation between online and in-store growth or decline is not strong enough to suggest a one-to-one replacement of brick-and-mortar establishments in the near future.

Sectors that have seen steady declines over this timeframe include Sporting Goods, Furniture & Home Furnishings and Clothing & Accessory stores. Despite the decline within the Sporting Goods channel, which is partially due to the lack of organized sports and physical activities, each channel offers products that consumers are generally hesitant to purchase without a first-hand experience where they are able to try on or test the products in person. While this ‘touch and feel’ experience is more important to some consumers than others, we believe that brick-and-mortar storefronts will continue to have a place in our Ecosystem of Product. This presents an opportunity for brands without a private retail presence to innovate and find ways to translate and digitize the in-store experience to give consumers the same peace of mind while driving their direct-to-consumer business.

I. Back in Business – In New Ways

While Americans are patiently waiting for the green light to reopen their doors, legislators continue to think through the dynamics at play so that the right precautions can be taken, monitored and maintained. Regardless of the measures recommended, disciplined action will be required by both employers and employees. One important action that will play a major role in this new environment is the communication process that will need to ensure that business owners can better understand each individual’s needs. Under these unprecedented conditions, decision-makers will also need to get creative to be able to strike the right balance between two critical concepts: Safety and Standard Operating Procedures. In order to find a way to keep people safe with minimal disruptions to business, the American Society of Safety Professionals published the following strategies:

1. Phased Approach Implementation: For positions where workers do not interact with the public (e.g. warehousing and manufacturing), the first phase could be bringing back 25%of the personnel, then 50%, and so on until capacity has been reached. If employees are normally spread across different buildings in a certain location, limiting their involvement to a specific building may be a safe step in the early stages. This could mean having functional roles be more specialized, and implementing effective hand-off procedures between team members, ensuring a more fluid process

2. Staggering Shifts: Another useful technique depending on the layout of the space. This could mean dividing office staff and creating a weekly rotation to give people time to ease back into their normal routine. This process also allows for more thorough sanitation efforts to take place between shift rotations.

3. Physical Barriers: It will be equally as important to take extra precautions to safeguard employees on the front-line (or those that interact with customers or the general public). This could mean adding physical barriers and placing markers that define recommended safe distances to minimize the risk of infection. Additional considerations include making barriers that will be easy to clean and maintain.

Regardless of the safety measures put in place by businesses, being proactive about preventing employee exposure will be important. A few things that can be done include the following: pre-screening, frequent monitoring, requiring masks, social distancing and cleaning and disinfecting workspaces and zones.

II. Human Capital Management in A Remote World

Over the last few months, the workplace has changed more than anyone could have anticipated and led to what some are now calling a “Remote Work Environment Revolution.” Corporations with the infrastructure to implement a permanent work from home policy are seizing the opportunity to do so (e.g. Twitter).

According to a survey released by business publishing company get Abstract, 43% of full-time employees want to work from home regardless of the economy reopening. Historically, the Consumer-Packaged Goods (CPG) and Supply Chain Industries have faced an uphill battle on the road to modernization, and in a world where convenience plays a major role in many job markets, this could put those businesses at a disadvantage when competing for strong candidates in the talent pool. Unfortunately, there is no ‘one-size-fits-all’ solution for effectively implementing a remote environment but executives considering the possibility have identified a few of the following key factors for assessment: impact on management, industry logistics and employee needs.

1. Impact on Management: The first thing that comes to mind for most employers is the impact on management. Working from home has been a challenge in and of itself but managing from home has additional dynamics that even more seasoned leaders have needed to work through. One of these challenges has been finding new ways to keep teams motivated. Although motivating teams can be challenging regardless of the line of work, we are seeing that future generations of senior leadership are being actively exposed to the process of adapting to challenges and developing new leadership styles that will mold and add value within new opportunities in their organizations.

2. Industry Logistics: Another important factor to consider is the industry logistics that exist for your company. Technology companies may find it much easier to transition completely remote than a hands-on, labor-intensive workforce. Once again, however, it is never too soon to start the dialogue with people on your team to better understand their needs and what they are comfortable with as it pertains to their day-to-day operations. To assess talent acquisition likelihood, it is important for management to understand which roles can and cannot be done remotely within your business. This could create new opportunities to attract top talent that may have otherwise had reservations about accepted in a job from another city, a different state, or anywhere in the world.

3. Employee Needs: Finally, it is hard to consider “going remote” without wondering what would happen to the physical office space if everyone is aligned to working from home.

Again, this will vary most based on the industry and employee preferences. A completely remote organization would benefit from lowered overhead costs, but that may not be feasible if you frequently host clients or contractors who need a temporary workspace. It is still unclear whether employee preference is to have the choice to come into the office or if they are prepared to make every aspect of their job virtual, thus making the physical office a thing of the pre-covid past.

III. Extended Payment Terms – The Ripple Effect

One of the results of business closures has been the decrease of disposable income, which have impacted front-line businesses across the board, but even more so, the group considered to be “non-essential.” With businesses continuing to open slowly throughout June, consumers are also going back to work and regaining access to the disposable income that keeps the front-line economic flywheel in motion. While this is great news, there is reason to believe that secondary service communities will not feel this immediate relief in increased throughput. For instance, in retail, many brick-and-mortar stores have been unable to turn inventory leading to shortcomings in their top-line revenue and problems with their bottom-line profitability.

In our April edition, we discussed how retailers were pushing for an extension on payment terms, and this is where we begin to see the impact of those decisions through the flow of vendors, manufacturers and suppliers.

The time it takes to normalize cash flow in the supply chain loop will be largely dependent on the variance of those term extensions and how long it takes days sales outstanding (DSO) to return to the appropriate levels of the impacted industry. The existence of these capital constraints further justifies a phased framework for bringing employees back to work. This can be instrumental in avoiding the financial burden associated with accruing expenses that cannot be supported by current cash flow.

IV. Finding Hidden Dollars for Your Business

Many entrepreneurs find themselves in a misleading circularity where they need to invest more dollars to drive additional revenue, yet to earn those investment dollars, they need to show additional added revenue. Although finding dollars to increase your research and development budget (R&D) or to support a new initiative is easier said than done, it is often necessary to stay ahead of competition, win in new markets and showcase your brand in a way that drives equity. According to an Inc. article by David Finkel, prudent vendor management is a great place to start the search for hidden available dollars.

In a world where many business processes can be outsourced, an unintended consequence can sometimes lead to having too many vendors or ‘too many cooks in the kitchen’ leading to inefficiencies and a lack in governance as opposed to a solution to your business needs.

Consolidating contracts and negotiating better pricing is a great tactic for compressing operating expenses and making your dollars go further. Many times, vendors will work with executives to reach a better price, even if it means bringing in new revenue streams for their business. One approach that businesses take is the frequent review of their contractors and implementation of project bids through an RFP process, where brands can choose solutioning paths that align to their vision and business capabilities.