Holiday Shopping Consumer Behavior

It is typical for the holiday season to generate excitement around our country’s homes and within families and despite this year’s unusual social climate, we do not expect that to change. This month’s newsletter, however, will focus on the changes that we can expect in the way that consumers embrace and share that holiday spirit and the impact that we can anticipate across our Ecosystem of Product.

While most American businesses have reopened (for now) and their respective supply chain systems have had a chance to either catch up or slightly makeup for unexpected consumer demand, the holiday season poses additional forecasting and execution challenges for suppliers. Towards the end of September, the NRF (National Retail Federation) started an ad campaign, “shop safe, shop early”. Around the same time, retail giant, Amazon, announced it would have their Prime Day in mid-October. Since then, we have also noticed many retailers expand the window for exclusive holiday deals.

I. ‘Shop Safe, Shop Early’

According to an insights study conducted by Deloitte in the U.S. earlier this year:

• 45% of participants stated they planned on beginning at some point in November

(23%before the Thanksgiving Holiday, and 22% after it)

• 15% stated they would begin in December

• 2% stated they would begin in January

Additional learnings from the study showed that consumers who planned to start shopping earlier, also planned to spend more than those who planned to do their holiday shopping later in the season. Consumers with disposable income to start shopping earlier also wanted the benefit of “getting what they needed on time.”

II. Fast Shipping vs. Free Shipping

One of the benefits that this shopper trend will have for businesses is the influx of cash flow earlier in the year, which poses an upside for the businesses who have been struggling financially in the first three quarters. Additionally, with supply delays and backorders in certain industries being a theme in the Ecosystem of Product throughout the year, spreading promotional campaigns during a longer duration would help flatten peak demands and the fulfillment curve.

Deloitte’s study also highlighted the importance of free shipping to consumers. With companies like Amazon constantly raising consumer expectations for delivery time, shoppers are even less willing to pay for faster shipping options.

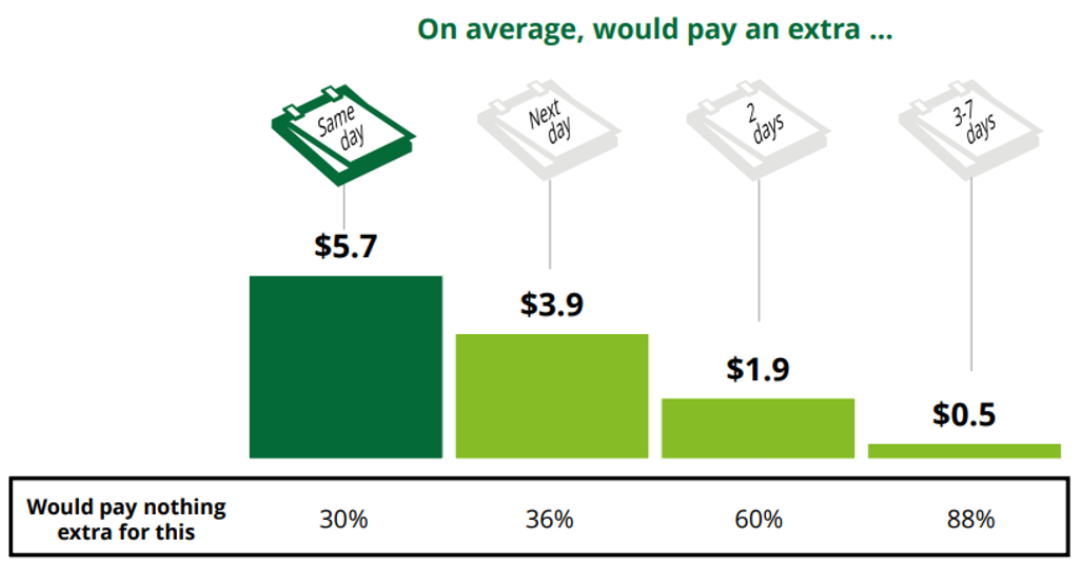

The study showed that to receive a standard-sized gift ($50-100), on average, 70% of shoppers were willing to pay an additional $5.70 for same day shipping, while the other 30% would pay nothing extra for this, as shown in the figure below. For 3-7 day shipping, the average shopper is willing to pay $0.50 extra during this time period, while 88% of consumers would pay nothing extra for this.

III. Products Motivating Consumers

In the years leading up to 2020, there was a major up-tick in experiential gift-giving and receiving among adults, especially in the millennial age group. According to a survey conducted by Eventbrite (an American event management and ticketing service), 63% of adults prefer to receive an experience gift rather than a material gift. Since we have spent some time discussing how consumers plan to shop in the holiday season, it only seems fair to spend some time unwrapping the ‘types’ of gifts that we anticipate they will be purchasing this holiday season – especially with the safety concerns that continue to make us think twice about being around large crowds or traveling.

A separate survey by a social content consulting agency, Fullscreen, found that people in their 30s and under show very little interest in both travel and live events. Of the 500 surveyed, only 7% said they would buy travel gifts and 14% said they would consider purchasing live entertainment-related gifts. Among the same group of individuals, 31% plan to purchase toys and 29% are going with technology upgrades for their friends and family.

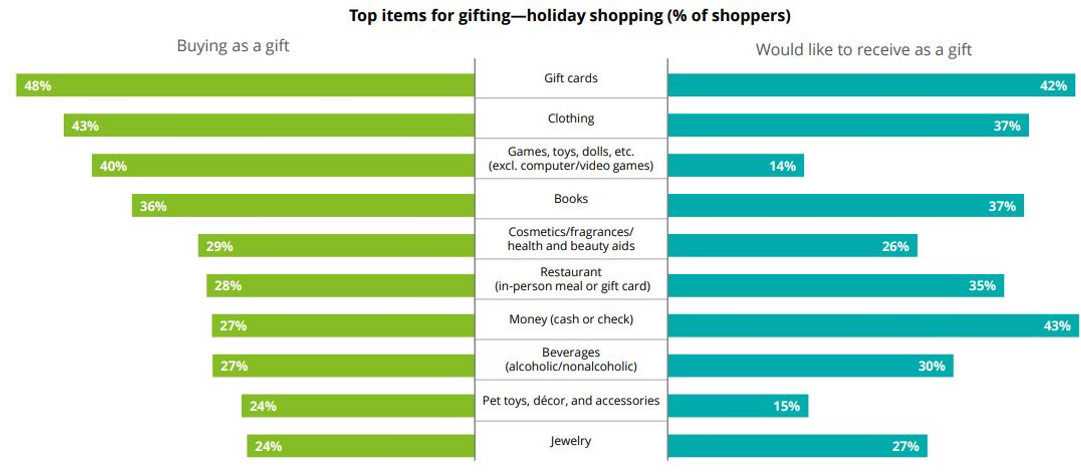

A report from Blackhawk Network forecasted that gift card sales would increase by 19% from 2019 which was already a large slice of the holiday spending pie. This resonates with what consumers are saying are their top items for gift-giving. As stated in a Deloitte poll, “Gift cards and clothing remain top items, while cash is still the most wanted item to receive.” As the gift-giver, gift cards, clothing, games, toys, dolls, and books were the top categories to purchase this year, while pet toys, décor, accessories and jewelry were towards the bottom of the list same list.

From the recipient’s perspective, those who were surveyed who showed the most interest in receiving cash, gift cards, clothing and books were least interested in receiving games, toys, dolls pet toys, décor and accessories.

IV. Where Will we Find Consumers and Why

Digging a little bit deeper into anticipated shopping patterns this holiday season, next we will take a look at Point of Sale (POS).

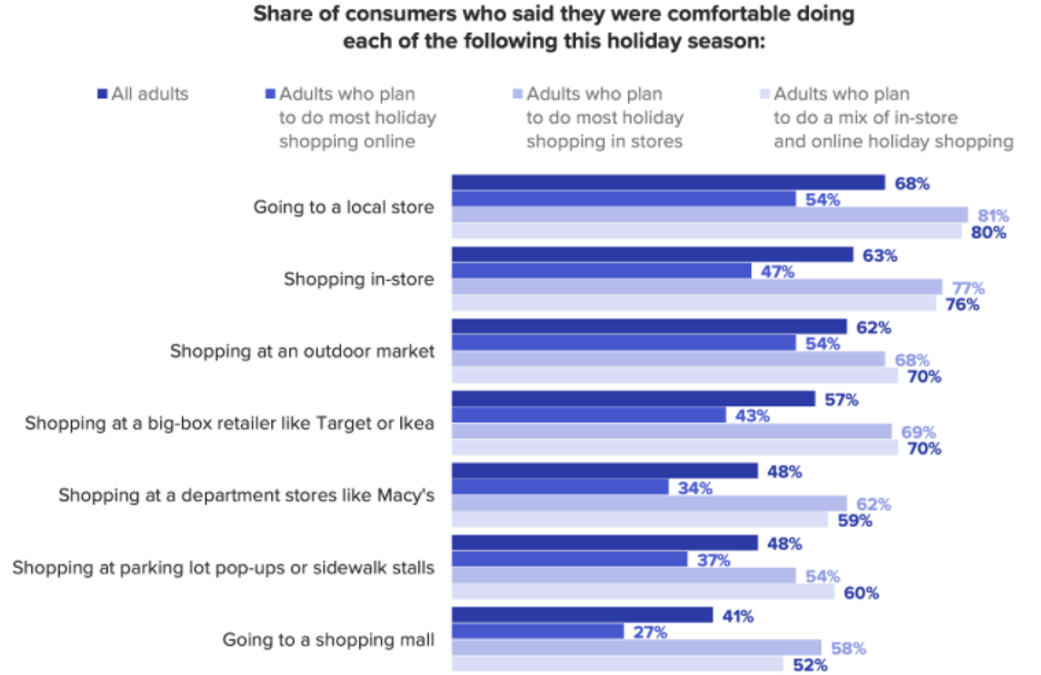

A poll conducted by Morning Consult grouped American consumers into the following three groups, according to their stated comfort level with holiday shopping methods:

2. Adults who plan to do most their holiday shopping in stores

3. Adults who plan to do a mix of in-store and online holiday shopping

Across all three categories, more than 50%stated they were comfortable going to local stores, but those comfort levels dwindle as the shopping venue gets bigger. When it came to going into shopping malls for their holiday shopping, the comfort sentiment decreased to 27%, 58% and 52% for each group respectively.

However, in a separate poll conducted with the same set of consumers, only about 20%-35% consumers felt like Covid-19 would significantly impact their holiday shopping decisions. This was particularly interesting given the impending shift between retail and digital shopping as it shows many consumers were already planning to do most of their shopping online despite Covid-19. This reinforces the need for brands and retailers to strengthen their position in the DTC and eCommerce sales strategies.

In conclusion, regardless of the types of products consumers end up purchasing and their purchase method, the top 10 attributes that consumers have highlighted as ultimately being their most impactful purchase drivers for retailer selection are the following: